reit tax benefits india

The tax on Long Term Capital Gains incurred by the investors when they sell the units REIT units after 3 years of holding is 10 if the LTCG are in excess of Rs 1 lakh. The interest and dividends received by the ReitInvIT from the SPVs is exempt from tax.

Real Estate Investment Trusts How To Build Your Own Reit Portfolio Real Estate Investment Trust Real Estate Investing Real Estate Investing Books

Indian infrastructure investment trusts InvITs and real estate investment trusts REITs have drawn investments from some of the largest global institutional investors sovereign wealth funds and pension funds.

. A maximum of 20 of the corporations assets comprises stock under taxable REIT subsidiaries. Despite how much assurance one has how these units will pay regular dividends for how long at the end investor have no control over how this works out. More than 30 countries around the world have established REIT regimes with more.

REIT regime in India Nature of income Taxation for REIT Taxation for unit holders sponsor Interest from SPV Exempt Taxable as interest income Withholding tax to be deducted by REIT on distribution. Such tax benefits if and when are provided in Indian REITs will act as a catalyst in making REITs more functional and attractive in the long run. REIT and InvIT 2013 2014 2016 2017 2018 2019 2020 Tax benefit extended to Private InvITs Dividend taxation Exemption to unitholders Exemption to SWFs PF investing in InvIT Regulations issued by IFSCA 1 new InvIT Indias second REITMindspace Business Parks Market capitalisation of listed REITs is INR 49256 crores listed InvITs is INR 22471 crores.

Till date REITs offer investors. These are generally transparent and hence if REITs are making money investors will earn too. The Short Term Capital Gains on the sale of units held for less than 3 year will be taxed at 15.

Wachovia Hybrid and Preferred Securities WHPPSM Indicies. The REIT has to compulsorily distribute at least 90 of their income which can be tracked from their filings. How REITs are listed on stock exchanges.

Preferred shares in addition to five. Form 1099-DIV is issued to persons who have been paid dividends and other distributions valued at 10 or more in money or other property. Thanks to the 2017 Tax Cuts and Jobs Act sweeping new changes to the tax code allow for a lucrative tax benefit for REIT investors.

Market capitalization weighted indicies designed by Wachovia to measure the performance of the US. Why REITs are significant for the Indian realty market. As of December 2016 Cushman Wakefield.

Rental income of the REIT. Interest payments and dividends received by a REIT from a Special Purpose Vehicle or SPV are exempt from tax. The Reit is also exempt from tax on its rental income which it may have earned if it owned a property.

REITs allow you to diversify your investment portfolio through exposure to Real Estate without the hassles related to owning and managing commercial property. Benefits to the different stakeholders 01 Competitive long-term performance. The Finance Act No2 2014 and the recent Finance Act 2015 clearly spelled out tax treatment of all possible streams of income for all parties associated with a REIT which paved the way towards introducing an internationally acclaimed investment structure in India.

Interest payments and dividends received by a REIT from a Special Purpose Vehicle or SPV are exempt from tax. According to sources since their introduction in India InvITs and REITs have together raised more than 36 billion of capital. A minimum of 95 of.

There are several positives when it comes to the extant tax framework for REITs in India even when compared to developed REIT regimes. Specific taxation regime has been introduced to deal with income earned via REITs. In India too REITs get a few key tax exemptions that are not available to other types of Real Estate companies.

Dividend income is taxed in the state s of residency regardless of the property situs. Reits in india listing stock exchanges real estate investment trust dividend tax benefits investors realty sector covid 19 sebi REITs in India. REIT regime in India Nature of income Taxation for REIT Taxation for unit holders sponsor Interest from SPV Exempt Taxable as interest income Withholding tax to be deducted by REIT on distribution.

The another drawback of REITs is that Indian goverment does not offer any tax benefits how to invest in REITs in India. This is summarised as follows. REITs will be listed on the stock exchanges.

Accrue a minimum 75 of gross income from mortgage interest or rents. REITs can have any property which earns rentals such as Malls Warehouses schoolcolleges hotels retirement homes casinos etc. Tax benefits As per regulations a distribution of at least 90 of taxable income each year to investorsunit holders for.

For instance when a REIT sells shares of assets the capital gains are taxable. The pass-through deduction allows REIT investors to deduct up to 20 of their dividends. The following are some of the key advantages for investors in REITs.

Siddhart Goel senior director research services India Cushman Wakefield says REITs will usher greater liquidity in the commercial sector while giving developers an option to exit projects including those developers who are reeling under a financial crunch. Further in other countries where REITs have been functional for a long time have been exempted from stamp duty. Since REITs are required to distribute nearly 90 of their earnings in the form of dividends to the REIT investors they can be assured of a higher income ratio.

Form 1099-DIV is an Internal Revenue Service form issued by a REIT brokerage bank mutual fund or real estate fund. As mentioned earlier one of the key problems associated with making Real Estate investments is the large ticket size especially in the case of commercial properties. Substantial stable dividends yields.

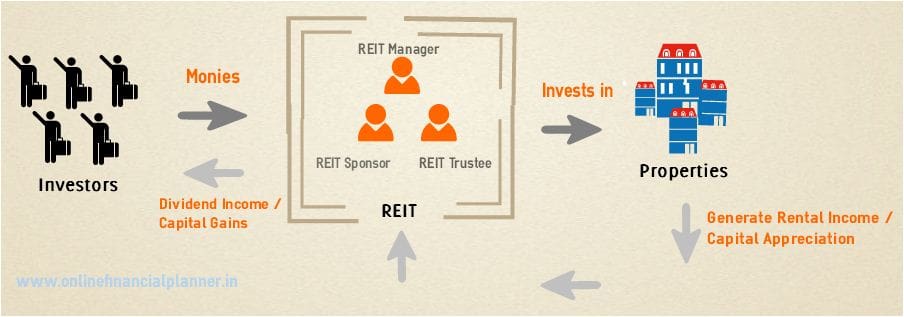

REITs dividend yields historically have produced a steady stream of income through a variety of market conditions. A Real Estate Investment Trust or a REIT is a collective investment vehicle that invests in a diversified pool of. For instance the withholding tax for foreign investors in India is 5 compared to rates as high as 30 49 and 24 in Japan Australia and Malaysia respectively.

A minimum of 75 of investment assets must be in real estate. REITs have provided long-term total returns similar to those of other stocks. The following are some key benefits of investing in REITs.

Benefits of Investing in REITs. The REIT is also exempt from tax on its rental income which it may have earned if it owned property directly.

Benefits Of Fmcg Crm Customer Relationship Management Crm Sales Process

Reits In India Features Pros Cons Tax Implications

Reit Investments Tax Implications In India Real Estate Investment Trust Investing Reit

What Are The Various Kinds Of Taxes And Charges You Have To Pay When Buying A Property Residential Plot Or Apartm Buying Property Property Property Marketing

Ease Of Doing Business In India Eodb Sunil Kumar Gupta Financial Advisors Business Mentor Real Estate Investment Trust

Top 10 Expectations Of Realestate Sector From Budget2017 Budgeting Single Status First Time

Tax Efficient Investing Bond Funds Fund Accounting Corporate Bonds

How Is Income From Invits And Reits Taxed Capitalmind Better Investing

Illustration Of Diesel Petrol Prices Build Up Under Gst Regime If Included Petrol Price Petrol Diesel

Difference Between Epf And Ppf Income Investing Investing Basic

What Makes Reits In India A Preferred Choice For Investors Housing News

Reits In India Structure Eligibility Benefits Limitations

How Is Income From Invits And Reits Taxed Capitalmind Better Investing

India Update Tax Implications On Invits Reits And Its Unitholders Under Finance Act 2020 Conventus Law

The M D Of Finlace Consulting Pvt Ltd Says That Sebi S Decision On Dlf Will Have Huge Impact Money W Financial Planning Real Estate News Financial Markets

How Income Tax Rules Help Reit Investors Earn More In Long Term Mint